You can easily apply for a self-refund of the tax charge for orders made from our official website directly from your Wondershare account. Please follow the steps below:

Step 1: Log in to Your Account: Sign in to the Wondershare Account Center using your Wondershare ID and password.

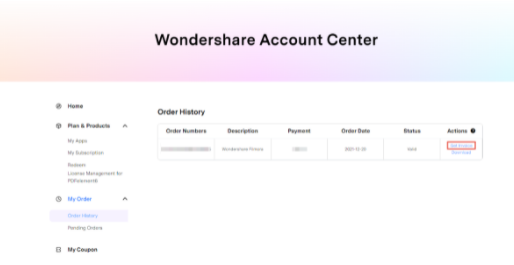

Step 2: Navigate to Order History: Click on "Order History" under the "My Order" section.

Step 3: Request an Invoice: Find the corresponding order and click the "Get Invoice" button next to it.

Step 4: Submit Your Tax Information:

-

Fill in your Name, Address, and VAT Number.

-

Click "Submit".

What Happens Next?

-

An invoice will be emailed to your licensed email address within 1 hour.

-

Your tax refund request will be automatically submitted simultaneously.

-

Please allow 3-7 business days for the refund to be processed and credited back to your original payment account.

If you do not have a VAT number but possess a valid tax exemption document, please email it to us at customer_service@wondershare.com. Our support team will promptly process a tax refund for you using the provided document.

Was This Helpful?

Thanks for your feedback.

Can you tell us what didn't work for you?

Feedback sent!